Agenda Digitale: KEYSTONE project advancing logistics supply chain oversight with data and technology

Screenshot of the news article published on the website of Agenda Digitale on 26 April 2024 (In Italian).

Digitisation is strategic for the logistics sector, which is severely tested by geopolitical crises and cost increases. The EU, through the NRP and projects such as FENIX and eFTI4EU, focuses on interoperability and data sharing to optimize processes and increase competitiveness.

The KEYSTONE project emphasises the importance of technology and shared data to improve control and enhance cross-border logistics compliance.

Over the past two years, we have witnessed a succession of geopolitical crises and their heavy impact on global balances. As far as the logistics sector is concerned, the Russian-Ukrainian and Israeli-Palestinian conflicts and the recent Red Sea crisis have contributed (and will continue to contribute) significantly to rising costs. At the Italian level, many ports and logistics hubs have experienced a worrying setback.

In such a context, digitisation represents a strategic asset to tackle the reduction of transport and handling costs. It is no coincidence that the European Union has decided to invest significant resources in the development of digital tools to improve interactions between all players in the logistics ecosystem.

PNRR funds for the digitisation of the logistics system and EU sustainability goals

The M3C2 mission of the PNRR, for example, is entirely dedicated to the digitisation of the country's logistics system. The plan provides an allocation of EUR 16 million for ports, EUR 10 million (already allocated) for freight villages and EUR 175 million for economic operators. The keywords are 'interoperability' and 'data sharing'. Europe aims to dematerialise corridor traffic by creating digital flows that enable greater efficiency and sustainability. The common goal is to solve the current bottlenecks in the exchange of data between private companies and public administrations, thereby increasing competitiveness concerning the market. Interoperability presupposes the availability of tools that enable dialogue, integration of information, and forecasts in an automated way. The development of standardised systems and shared semantics enables the integration of existing systems and the elimination of complicated conversion operations.

European Projects

Starting with the FENIX project (co-financed by the CEF policies and ending in 2023), the first federations of digital systems were born in Europe. The synergy between logistics operators and experts in the development of technological solutions made it possible to develop new tools for the exchange of information between different platforms. The FEDERATED project (concluded this year) provided the first European semantic model through which a standard enabling all member countries to communicate is conceivable. In addition, the eFTI4EU project will work until 2026 on logistics management systems through the adoption of the eFTI protocol (distributed through a data model), as foreseen by the European Regulation 2020/1056. This new electronic document exchange system will be adoptable from August 2024. Public administrations and, thereafter, private economic operators will be required to adapt their IT systems. The eFTI standard will make available to all member countries several services that are currently provided by the various logistics nodes in a multimodal manner.

KEYSTONE Project

Among the various projects financed by the European Commission, it is undoubtedly important to mention the KEYSTONE project, which aims to support the enforcement authorities engaged in controlling and verifying that the transport of goods takes place according to the current security rules.

To collect the needs and obstacles that currently affect the controls carried out by the Authorities, the KEYSTONE project developed a conversational survey and administered it to three different types of targets: a) logistics operators b) rail terminals c) Enforcement Authorities.

From 13 September 2023 to 20 March 2024, 262 responses were collected: 168 from logistics operators, 18 from rail terminals, and 76 from enforcement authorities. The geographical distribution of the responses can be seen in Fig. 1.

Fig. 1. Geographical distribution of the responses collected for the three target groups (source "D1.1. Stakeholders' identification and needs")

The survey aims to investigate the aspects to be considered to improve compliance checks, the digital tools used (both at the national and European levels), the data already shared between authorities and logistics actors (such as logistics operators, transport companies, and freight terminals), and the data currently not shared that could help optimise logistics processes. The analysis of the responses highlighted important aspects at the European level that will enable KEYSTONE to lead the development of innovative technologies.

The importance of technology and data in improving and enhancing compliance checks

Data and technology play a key role in improving and enhancing compliance checks by enforcement authorities, optimizing logistics processes, and promoting transport sustainability. 76% of logistics operators, 100% of rail terminals, and 88% of enforcement authorities surveyed are convinced of this.

In addition to IT platforms, logistics operators are striving to enhance the efficiency of their infrastructure. For example, through automatic image capture and text conversion (OCR) technologies, the data of passing vehicles can be tracked, analyzed, and utilized in near-real-time. Once equipped with these technologies, intermodal nodes can assume the role of 'checkpoints' on transport arteries.

Moreover, Italy is investing in 'gate automation' throughout the country, with co-financing by the European Union. The availability and accessibility of forecast data enable the implementation of preventive actions, benefiting the operational planning of people and vehicles. This optimization of resources helps in decongesting the road network and buffer areas. Strengthening the road/rail modal shift, facilitated by data availability and accessibility, positively impacts transport sustainability and bridges the gap towards achieving the EU 2050 objectives.

While the digital transformation is widely acknowledged as crucial, 24% of logistics operators and 12% of enforcement authorities highlight the need for more attention to administrative and organizational aspects. According to survey participants, legislation should be simplified and harmonized across EU Member States. Moreover, factors such as the geopolitical context (e.g., non-EU borders, Brexit, regulatory uncertainty), language barriers, the nature of shipments (e.g., dangerous or perishable goods, project cargo), and the technical readiness of personnel require more careful consideration.

Data Sharing with Enforcement Authorities: Challenges

Fig. 2. From left to right: Percentage of logistics operators sharing data with authorities and authorities involved (source "D1.1. Stakeholders' identification and needs")

The survey indicates that data sharing with enforcement authorities encounters significant challenges. Sixty percent of surveyed logistics operators report sharing data with authorities, with 18% sharing data with all authorities. However, the remaining 42% share data only with select authorities, primarily customs and port authorities (see Fig. 2).

For rail terminals, the primary obstacle to data sharing is the absence of suitable IT tools. However, for 40% of surveyed logistics operators, the challenge extends beyond technology limitations. In numerous countries, electronic data sharing is not feasible. Additionally, shared documentation may contain sensitive company and customer information. Without legal assurances, widespread data sharing becomes problematic. Consequently, unless mandated explicitly or offering clear benefits, logistics operators are hesitant to share their data.

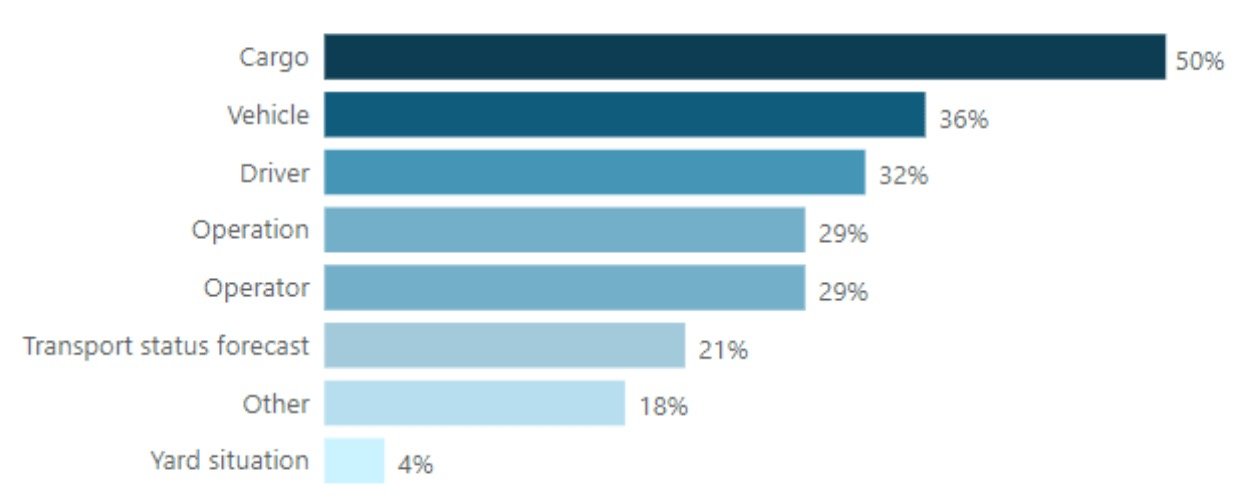

However, the primary categories of data (Fig. 3) shared by logistics operators and rail terminals with authorities include:

Fig. 3. Main types of data shared with authorities (source "D1.1. Stakeholders' identification and needs")

Cargo details (e.g., types of goods, permits for specific cargo transportation, cargo securing)

Vehicle information (e.g., vehicle's technical state, weight and dimensions, year of registration)

Transport type (e.g., national, bilateral, cabotage, occasional)

Driver particulars (e.g., driving logs, working and rest time records)

Fig. 4. Data exchange between logistics operators and other actors (rail terminals or other logistics operators) (source "D1.1. Stakeholders' identification and needs")

Data sharing with authorities occurs through various technology platforms. Some of these platforms are internally developed by individual companies, while others are commercially available. Additionally, data exchange with authorities may also happen through email and spreadsheets in certain cases. This diverse landscape underscores the presence of varied and often incompatible solutions, highlighting the need for a technological standard.

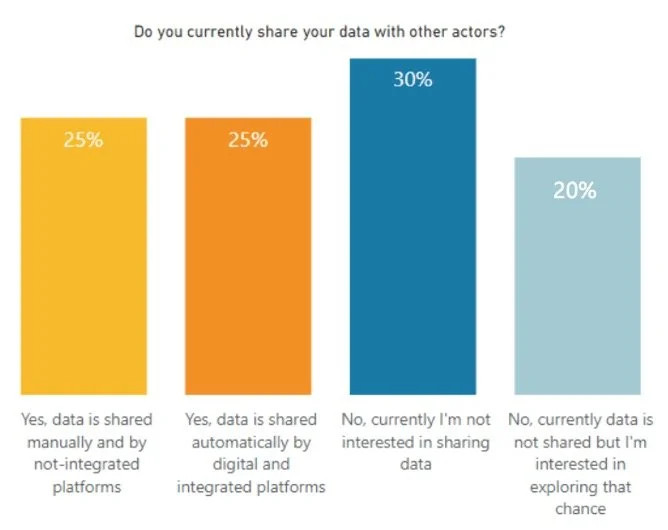

In addition to enforcement authorities, logistics operators and rail terminals also exchange data with other stakeholders. Fifty percent of surveyed logistics operators indicate sharing their data with other logistics operators and rail terminals. Of these, a quarter exchange information automatically through integrated platforms, as depicted in Figure 4.

20% of the surveyed logistics operators expressed interest in data sharing but currently do not engage in it. The primary reasons for the lack of data sharing include the absence of apparent benefits or advantages and the lack of suitable digital systems. Additionally, 30% of logistics operators cited concerns regarding confidentiality and competition as reasons for their disinterest in data sharing.

Fig. 5. Data exchange between rail terminals and other actors, e.g. logistics operators or other rail terminals (source "D1.1. Stakeholders' identification and needs")

Regarding rail terminals, 71% of respondents reported sharing their data with other stakeholders, such as logistics operators or other freight terminals (see Fig. 5). Among these terminals, 57% exchange information automatically through integrated platforms. However, terminals highlighted that the absence of adequate platforms significantly hampers information exchange.

The demand for data

In anticipation of a digital ecosystem where each participant contributes and utilizes data, logistics operators and rail terminals express a need for additional data that is currently not shared with them. Logistics operators, for instance, could leverage information on road conditions and situations (such as traffic congestion, accidents, road closures, border crossing wait times, train and ship delays, weather advisories affecting roads, parking availability, height restrictions, etc.) to enhance their operations.

From the viewpoint of enforcement authorities, 85% of the respondents indicate that specific data, presently not shared by stakeholders (such as logistics operators, terminals, and authorities in other countries), could significantly enhance inspections. Certain authorities underscore the importance of information exchange regarding vehicle conditions (Roadside Inspection and Periodical Technical Inspection), which could prevent redundant checks on the same truck during a single journey.

The importance of a centralised database

A centralized European database like the one implemented for the Certificate of Compliance (COC) could also be a good solution to implement. Other respondents believe that it would be important to have more data to combat and solve fraud-related crimes more efficiently. The data desired by enforcement authorities are all those that can help officers to prove with certainty the route taken by the vehicle to the point of inspection (traffic data, shipping manifests, toll data, etc.). For example, GPS vehicle tracking could be used to verify actual tachograph data and exclude manipulations. Sharing shipping manifests (containing information on people on arriving ferries) could help profile arriving operators and identify high-risk ones. Other useful data to improve controls include cargo, mileage or kilometers traveled, shipping order forms, weighing documents, accurate traffic and roadblock information, ETA (estimated time of arrival), origin-destination data, and terminal waiting times.

Data sharing between European countries

Data sharing between European countries is another aspect highlighted by the enforcement authorities interviewed. Authorities would like to share real-time data on drivers' licences and operators' licences, as well as data on bad transport practices in each country. Data on drivers and transport company documentation should be exchanged between Member States via the ERRU system[8], but currently some states (e.g. Portugal) do not use this application for data sharing. Finally, according to the enforcement authorities interviewed, the way in which data is shared between Member States should comply with EU Regulation 2020/1056 (eFTI).

With regard to this regulation, it is worth mentioning that following a careful analysis of the level of communication between public administrations and businesses, the European Commission deemed it necessary to provide an appropriate tool. Indeed, for some years now, Europe has no longer been funding new IT platforms, but has been clamouring to make existing ones intercommunicating. The eFTI delegated act[9], already published in December 2023 and developed by a pool of experts selected through a call for tenders by the European Commission, will provide guidance for the modification of the IT systems of public administrations in all member states. The eFTI implementing act will then set out the terms and modalities of the new EU digital system. The invitation, as yet not an obligation, for private economic operators is to comply with the eFTI digital protocol by 2029. Therefore, even if there is no certainty at the moment, it is likely to be expected that all control and monitoring systems will be eFTI-compliant by 2029. In support of what has just been said (at least at the Italian level), it is worth emphasizing that in recent times, an increasing number of private entities have been investing their own resources to comply with the new data exchange system.

Platforms (national and European) used for controls

The enforcement authorities of each EU Member State now have specific technology platforms (e.g. Port Community Systems). These platforms respond to the needs of a specific authority and are often not integrated with other platforms.

Fig. 6. Need to improve existing platforms (source "D1.1. Stakeholders' identification and needs")

85% of the surveyed executive authorities believe that the platforms currently in use should be improved and enhanced, mainly by integrating new data sources, see Fig. 6. The executive authorities interviewed would like to have real-time, Europe-wide transport data to carry out immediate checks. This means, for example, that the Italian traffic police would like to have vehicle and driver data directly available in the field (e.g. tachograph card data, CPC card data, driving licence data, vehicle technical inspection data, etc.) — whether Italian or from another country.

In addition, according to the interviewed authorities, other relevant additions could concern data on inspections carried out on operators according to the EU common risk classification formula, authorisations and violations in other states, on-board diagnostics (OBD) data, satellite tracking data, toll charges, cargo data (quantity of cargo, place of delivery, transport route, number of passengers travelling on board, tachograph data, driver data as qualification), transport company data and rail transport data.

According to the executive authorities interviewed, integration with data shared via existing European Authority-to-Authority (A2A) platforms is also necessary. In fact, over the past 20 years, the European Union has designed and made available to the authorities of the individual Member States a series of databases and IT platforms (e.g. ERRU, TACHOnet, EUCARIS, IMI, etc.) to facilitate cross-border verification and control activities.

Fig. 7. Platforms used by authorities to carry out controls (source "D1.1. Stakeholders' identification and needs")

69% of the authorities surveyed state that they use one or more of these platforms to carry out checks, as shown in Fig. 7. On the other hand, 23% of the authorities surveyed are not aware of these platforms and 8%, although they are aware of them, do not use them. The most used EU platforms are TACHOnet, IMI and ERRU, as shown in Fig. 7.

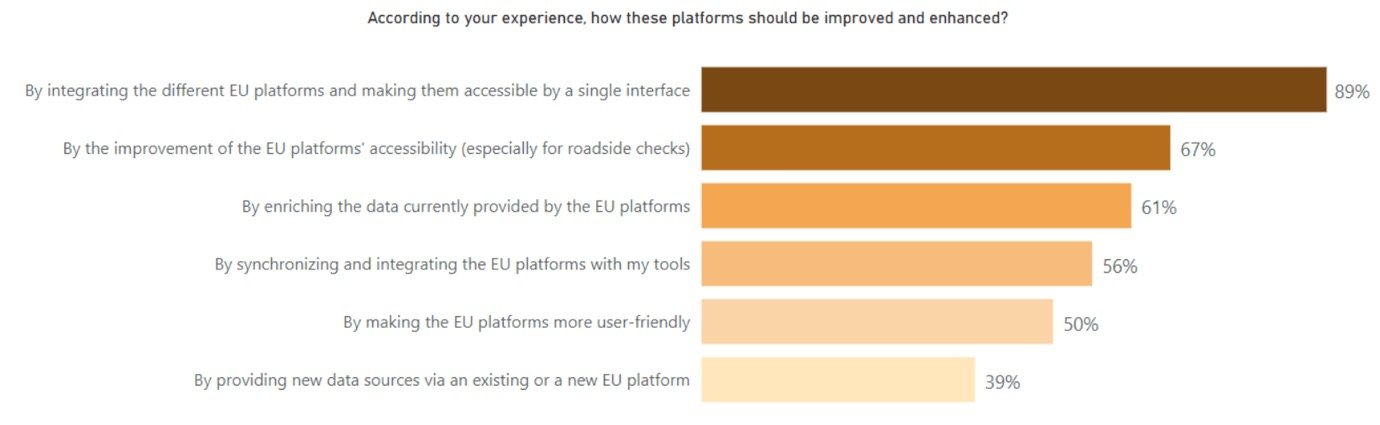

TACHOnet is used by almost all respondents and IMI by 89%. Resper and eFTI platforms are used by less than 10% of the respondents. For those authorities that stated that they use at least one of these EU platforms, an important improvement would be to integrate the different EU platforms and make them accessible via a single interface.

Fig. 8. Aspects to be improved in the platforms currently used by the authorities (source: "D1.1. Stakeholders' identification and needs")

According to the authorities, the accessibility of the platforms (especially for roadside checks) should also be improved and their current catalogue of data enriched, see Fig. 8.

Of the logistics operators interviewed, only 17% exchanged information with such European platforms, see Fig. 9. These EU platforms are integrated with the national one in only half of the cases. According to those logistics operators that have not integrated their system, an integration could help to reduce the administrative burden. The main problem to be solved relates to the harmonisation of data formats and interfaces.

Fig. 9. Percentage of logistics operators exchanging data with European platforms and platforms used (source: "D1.1. Stakeholders' identification and needs")

On the other hand, none of the interviewed railway terminals have ever exchanged information with European platforms designed to facilitate cross-border compliance checks.

The benefits of the KEYSTONE project

In conclusion, almost all interviewees agree that data and technology play a key role in improving and enhancing compliance checks. According to some logistics operators, other factors currently complicate control activity in the supply chain, e.g. legislation, cooperation between Member States and the geopolitical context.

About 60 per cent of rail terminals and logistics operators share their data with the authorities. According to terminals, the main obstacle to sharing data (both with authorities and with other actors) is the lack of adequate technological tools. On the other hand, if not mandatory, logistics operators do not see any benefit in sharing their data with other actors.

According to the answers to the survey, there is no single platform (national and/or international) able to enable information sharing. Stakeholders may adopt email, internally developed software and/or commercial solutions.

All stakeholders who completed the survey are aware of the importance of data and its exchange to improve business opportunities. Eighty-five percent of authorities, 71% of terminals, and 57% of logistics operators stated that they need more data.

Finally, it is worth highlighting the situation concerning the use of European platforms. The terminals that completed the survey claim that they have never exchanged information with such platforms. Only 17% of logistics operators have used these platforms at least once. On the other hand, 69% of authorities use EU platforms while 23% of authorities are not even aware of them. TACHOnet and IMI are the most used platforms (over 90% of respondents). No one has ever used Resper. According to the answers given by the authorities, the EU platforms are not interlinked and need to be consulted separately to get a holistic picture.

The authorities suggest integrating the different EU platforms and making them accessible through a single interface. The accessibility of the EU platforms is poor, especially during roadside checks. Finally, according to the authorities, further data should be integrated into these platforms.

In such a scenario, the Keystone project represents the first step towards interoperability with law enforcement systems. Considering that the platforms currently used for traffic monitoring and management are those of the operators (TMS, TOS, PCS, WMS, etc.), it is worth emphasising that none of these platforms is connected to the systems of the security control bodies. The authorities' IT systems are often one-sided: they request information from the operator and do not provide it. The request for information is left to the direct interaction between the agents and the offices of the logistical nodes and is done purely by email.

Conclusions

The KEYSTONE project aims to provide a tool (Fig. 10) that, thanks to standard technologies and protocols (eFTI, APIs, APPs), is accessible to all actors, including enforcement authorities. The use of standard technologies and integration between different platforms will make it possible to reduce (if not eliminate) manual and repetitive data entry and updating activities. For this reason, logistics operators, seeing an opportunity to optimize their processes (saving time, reducing errors), are genuinely interested in participating in this initiative.

Find the survey and the full article in Italian available below.